Rich Dad Poor Dad by Robert Kiyosaki|learning English with ultimate best seller of financial book

(25, March, 2023)

※I am a Japanese, learning English as a second language. This article aims to inform you how effective it is to read this book for your learning.

This article is about:

・Rich Dad Poor Dad(2000) by Robert Kiyosaki, ultimate best seller of a financial book, which sold nearly 30,000 copies.

・You can check out the book information, plot, pros & cons of this book and how it is recommended for English learning.

・To whom this book is good to read.

・Will quote some portions from the book. You can check it out and decide if you will actually try to read the book.

1.Prologue

There are a lot of financial books out there these days, but this book has been issued 40 million copies all over the globe. It is Rich dad poor dad(2000) by Robert T. Kiyosaki. I have read the book for English learning purpose, getting some financial knowledge at the same time.

This article aims to sum up information about this book, plot, pros & cons, who should read this book, and my review. You can check out some quotes from the book, so if you like it, please try to read the book.

【読了】

金持ち父さん 貧乏父さんを洋書で読破しました📘

既に資産運用や投資を行っていて、英語の勉強をしている方にはとてもおすすめ😀

投資のモチベーションが上がる一冊💹

マネーリテラシー本界の不滅の金字塔👍https://t.co/DU47rRcfX1#英語学習 #多読 #洋書#洋書多読 pic.twitter.com/9fYuvdEDNh— みっちー@英語学習ブロガー (@michi1009_t) February 17, 2023

In conclusion, I recommend this book for English learning purposes for those who have some financial intelligence and experience already. If you are not interested in financial or investing things, this book is not for you.

2.Book Information|Rich dad poor dad(2000) by Robert T. Kiyosaki

| Title | Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! |

| Author | Robert T. Kiyosaki and Sharon L. Lechter |

| Nation | USA |

| Genre | Personal finance |

| Publisher | Warner Books |

| Issued in | 2000 |

| Number of pages | 336 or 207 |

| Number of words | 61,479 appx. |

Reference:Wikipedia, Rich Dad Poor Dad

・About the author

Author of Rich Dad Poor Dad is Robert T. Kiyosaki, born in Hawaii, USA. He is a Japanese American, 4th generation. As I am a Japanese grown up in Japan, I feel sympathy in a way but his way of life is thoroughly americanized. He was born in 1947, and is 75 years old now (March, 2023).

His occupation is Investor, Entrepreneur and Writer about Financial Intelligence. He used to work for companies like Xerox and Standard Oil, where he performed quite well as a sales leader. I assume that his earning ability was brilliant from the beginning of his career, so his success story is not the one that everyone can make true.

His SNS information follows.

・Twitter:@theRealKiyosaki

・Instagram:therealkiyosaki

・Rich Dad Company:https://www.richdad.com/

・Plot

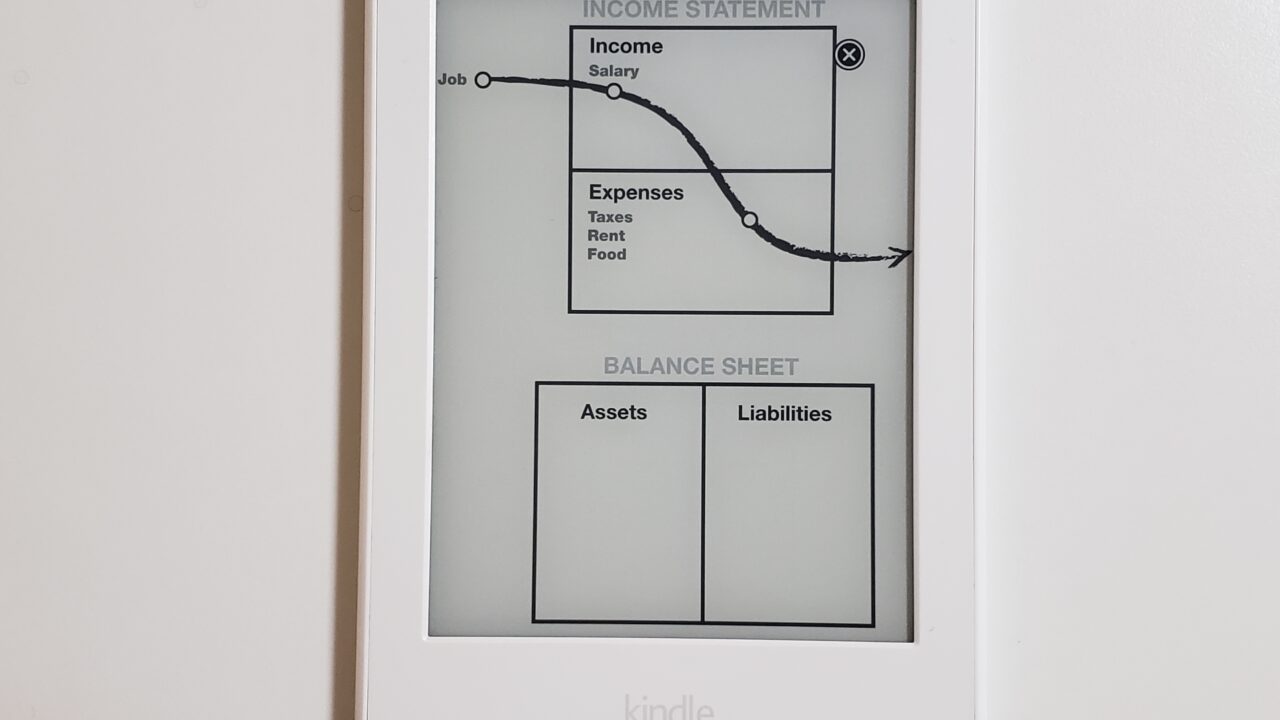

This book is written in the author’s autobiographical style. He explains what’s the difference between riches and poors, comparing his real father(poor dad) and his mate’s father(rich dad). Poor dad works for money to spend, which the author calls ‘Rat Race’, while Rich dad’s money works for him. In order to make money work for you, you need to buy assets. He says ‘increase assets in your portfolio’.

In the book, the author also shows his experience in his career. And he says you should experience various jobs in various companies, even if it does not make big money straight away. It gives you financial knowledge to make money in the long run.

Then he also shows his success story of investments, mainly by real estate in the US. To save money by avoiding unnecessary tax, he recommends founding your own company.

3.Pros and Cons~Who should read this book?|Rich dad poor dad(2000) by Robert T. Kiyosaki

Rich dad poor dad(2000) by Robert T. Kiyosaki is very controversial. In Japan, my country, many financial influencers or youtubers pick up this book. It will highly motivate you to start investment, which is a good point of this book. On the other hand, just starting investing by reading this book is not preferred. Here are Pros & Cons, and who should/should not read it.

✅Pros

・It will motivate you; feel like starting a new investment on something. If you have some financial knowledge and experience, it is a good motivator book.

・It will remind you to review your portfolio; Is my investment okay? Can I take more risks? or things like that.

・It is written mainly in conversational style; English is easy to comprehend.

✅Cons

・The author is American, which is the biggest investing market. Some topics can not relate to other countries.

※For example, the author suggests you to experience many jobs in various companies to acquire skills, but in my country Japan, it is not a good thing to change your jobs frequently; you might be seen as a job hopper.

Meanwhile, the author also says ‘Don’t be balanced’, quoting successful billionaires such as Thomas Edison, Bill Gates and Donald Trump; they were not balanced, extremely talented in specific one field. Don’t you think it is a big contradiction?

・The author’s success story is difficult to make in other countries. In my country Japan, real estate and stock market are not strong like the US.

Then, who should/should not read this book?

✅Who should read this book?

・People who have investing knowledge and experience, learning English at the same time.

Written in simple English in conversational style. It will highly motivate you for further investment.

・People who already know the standard method of investment.

✅Who should not read this book?

・People without investing experience.

・People who don’t know the standard method of investment.

As Rich dad poor dad is written by an American author, things are not always applied to other countries. The US financial circumstances are the best among the world; the stock/real estate market keeps expanding and the population is increasing, while my country Japan’s market is not so strong.

Investment always takes risks, so you have to select information to take in, by yourself. If you have no basis of financial knowledge, this book is not recommended.

After 20 more years(now in 2023) since the book were published, this book is still controversial and people exchange opinions about Rich dad poor dad. In my opinion, the most important thing is what is the FINEST asset. The author says ‘Rich buys assets, which is the money works for you’. In this context, you should know what is a good asset. Otherwise, it will not work well for you. If you don’t have financial knowledge to judge which asset to keep, better to read other financial books. Rich dad poor dad is often treated like a beginner’s financial book, but I think it is not true.

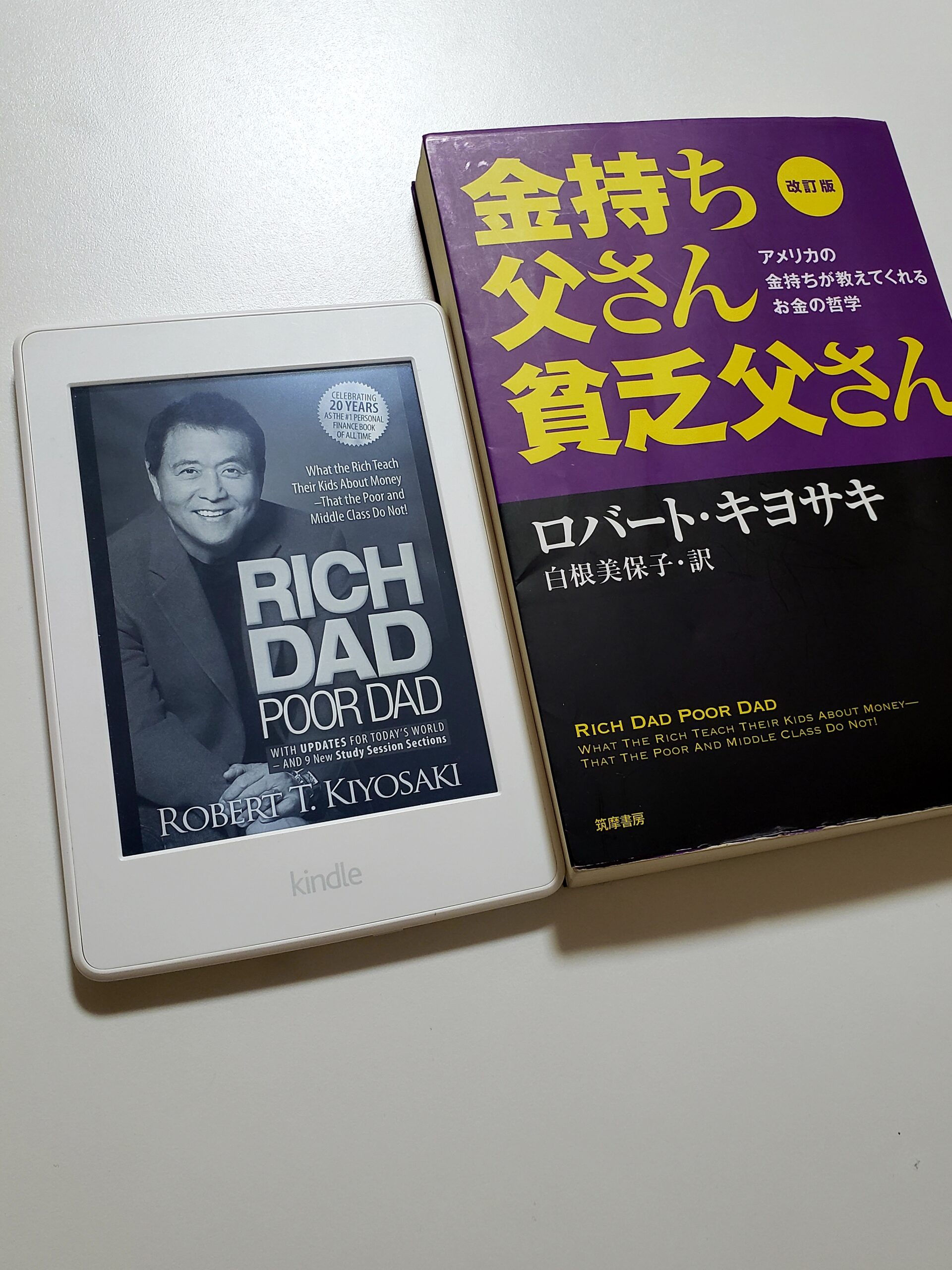

Rich dad poor dad, English(Left) and Japanese(Right) version

Rich dad poor dad, English(Left) and Japanese(Right) version・English level~Quotes from the book|Five star recommended for English learning investors

Rich dad poor dad is highly recommended for English learning aiming for vocabuild, 5 star recommend. It is written in simple English and conversational style. If you have TOEIC score around 650, you can read through comfortably. It may develop daily English conversation vocabulary. In terms of language learning, this book is very good, in condition that you have financial knowledge and experience already. Check out some quotes from the book below.

✅Famous and controversial phrase, your home is a liability, not an asset.

One believed, “Our home is our largest investment and our greatest asset.” The other believed, “My house is a liability, and if your house is your largest investment, you’re in trouble.”

Kiyosaki, Robert T.. Rich Dad Poor Dad (p.12). Plata Publishing, LLC.. Kindle 版.

✅Another famous phrase

The poor and the middle class work for money. The rich have money work for them.

Kiyosaki, Robert T.. Rich Dad Poor Dad (p.32). Plata Publishing, LLC.. Kindle 版.

✅About the rat race

People’s lives are forever controlled by two emotions: fear and greed. Offer them more money and they continue the cycle by increasing their spending. This is what I call the Rat Race.”

Kiyosaki, Robert T.. Rich Dad Poor Dad (p.39). Plata Publishing, LLC.. Kindle 版.

✅Importance of intelligence.

You should keep on learning to acquire financial intelligence.

School is important, he told them, but for most people it’s the end, not the beginning.Kiyosaki, Robert T.. Rich Dad Poor Dad (p.57). Plata Publishing, LLC.. Kindle 版.

・Should take classical investing methods first

Rich dad poor dad is recommended for people with some financial knowledge. If you are not familiar with it, you should know what a classical financial method is. Focussing on the stock investment field, recommended books follow. (Click link to open Amazon shopping website).

・A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy

4.Epilogue

This article brought you information of the best seller financial book Rich Dad Poor Dad(2000) by Robert Kiyosaki; the book information, plot, pros & cons of this book and how it is recommended for English learning, who should read this book, and some quotes from the book.

It is written in easy, conversational English, so I could have enjoyed reading it comfortably. This book is not recommended as a starter into investment, but if you are the English learning investor, this book is perfect for vocabuilder.

I hope this article will help your learning.

→Back to Chapter 2 to check out the book info

Fin.